The banks Crédit agricole and Credit Suisse participated in a cartel in the sector for suprasovereign bonds, sovereign bonds and public agency bonds denominated in US dollars

According to the Judgment of the General Court in Cases T-386/21 (Crédit agricole and Crédit agricole Corporate and Investment Bank v Commission) and T-406/21 (UBS Group and Credit Suisse Securities (Europe) v Commission), the banks Crédit agricole and Credit Suisse participated in a cartel in the sector for suprasovereign bonds, sovereign bonds and public agency bonds denominated in US dollars (‘SSA Bonds’).

The General Court of the European Union confirms the Commission’s finding of an infringement and maintains the amount of the fines imposed in 2021.In 2018, the European Commission initiated proceedings for infringement of the competition rules involving Deutsche Bank, Bank of America, Crédit agricole and Credit Suisse (now UBS Group [1] ).

In 2021, the Commission found that those banks had entered into an agreement on the secondary market for suprasovereign, sovereign and agency bonds denominated in dollars (SSA bonds). According to the Commission, traders employed by those banks entered into an agreement on trading and pricing strategies and exchanged commercially sensitive market information relating to their current or future activities (prices of their bids or offers, trading positions, strategy and behaviour of identified clients).

Those exchanges took place via chat rooms on the internet [2] or via discussions by electronic means or by telephone, over the period between 19 January 2010 and 24 March 2015. [3]

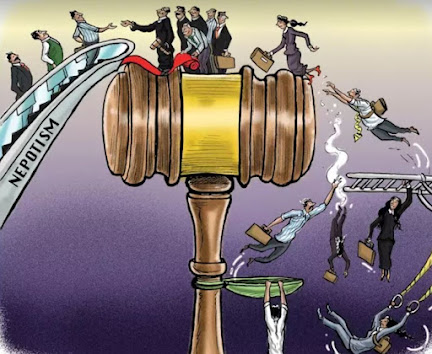

The Commission concluded that the banks concerned had participated in a single and continuous infringement covering the entire European Economic Area (EEA), which consisted of agreements and/or concerted practices that had the object of restricting and/or distorting competition in the SSA bond sector. It therefore imposed a fine of €12.6 million on Bank of America, a fine of €11.9 million on Credit Suisse and a fine of €3.9 million on Crédit agricole.

By contrast, Deutsche Bank was granted immunity from fines due to its cooperation during the investigation. Crédit agricole and Credit Suisse have each brought an action for the annulment of that decision in so far as it concerns them. Crédit agricole also requests a reduction of its fine. They both claim that the Commission made errors of assessment in finding that they had participated in an anticompetitive agreement in the SSA bond sector and in the calculation of their respective fines.

The General Court dismisses Credit Suisse’s action in its entirety. By contrast, it annuls the contested decision in relation to Crédit agricole, but only in so far as the Commission found that that bank had participated in the infringement from 10 January 2013 to 24 March 2015, when that participation was established only from 11 January 2013 to 24 March 2015. However, that does not affect the amount of the fine imposed on Crédit agricole, which the Court decides to maintain at the sum of €3 993 000. [4]

The Court holds that the conduct adopted by the traders of the banks concerned formed part of an overall plan pursuing a single anticompetitive objective even if, after February 2013, the discussions between those banks’ traders were less frequent. Those traders continued their anticompetitive discussions repeatedly, freely exchanging information about their ongoing trading activities.

The Court also holds that the Commission did not make any error in finding that the conduct of the four banks concerned had an anticompetitive object and that it therefore did not have to demonstrate its effect on competition. In that context, the Court considers that the Commission did not make any errors in assessing the economic context of the conduct at issue, in assessing whether it was sufficiently harmful to competition or in assessing the claim that the conduct was justified by virtue of its ‘favourable’ implications.

Lastly, the Court endorses the methodology for calculating the fine applied by the Commission. That methodology was based not on the turnover of the undertakings concerned – as is usually the case – but rather on a proxy for that turnover. That proxy was calculated on the basis of the notional amounts of the SSA bonds which the penalised banks traded during their individual periods of participation in the infringement at issue; an adjustment factor was applied to those amounts, itself calculated on the basis of the spreads between the purchase price and the sale price of representative categories of SSA bonds acquired and then resold by each bank. (source: curia.europa.eu/photo freepik.com)

_____________

1 In June 2023, UBS Group formally acquired Credit Suisse Group and all the rights and obligations of that bank. UBS Group therefore replaces Credit Suisse Group in the action in Case T-406/23, brought on 6 August 2021.

2 The traders logged on to multilateral or bilateral chat rooms, mainly on forums on the Bloomberg platform.

3 As regards Crédit agricole and Credit Suisse, the Commission found that they had participated in the agreement, respectively, from 10 January 2013 until 24 March 2015 and from 21 June 2010 until 24 March 2015.

4 Exercising its unlimited jurisdiction, the Court has ruled on the question whether the reduction in the duration of Crédit agricole’s participation in the infringement at issue from 574 to 573 working days necessitated a change in the amount of the fine imposed on that bank. Having regard in particular to the duration – albeit slightly reduced – of Crédit agricole’s participation in the infringement at issue and to the gravity of that infringement, the Court has considered that there is no need to amend the amount of the fine imposed on that bank for the single and continuous infringement during the period that it used.

Comments

Post a Comment